Applicability of federal motor carrier regulations to passenger operations

The Federal Motor Carrier Safety Administration (FMCSA) is the federal agency charged with regulating the interstate operation of commercial motor vehicles. It does so through its promulgation and enforcement of its Federal Motor Carrier Safety Regulations (FMCSRs) in title 49 of the Code of Federal Regulations, Parts 390-399.

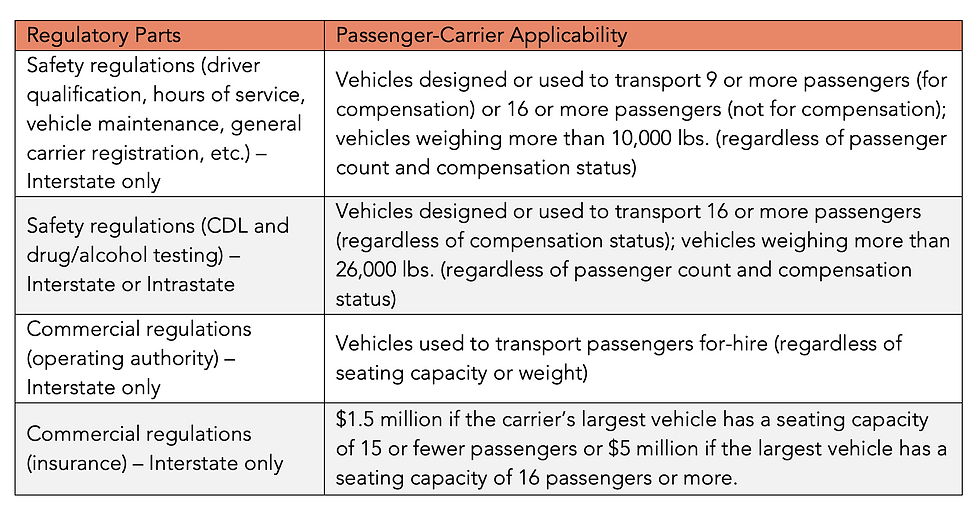

The manner in which the FMCSA regulates property carriers differs from the way it regulates passenger carriers. As addressed in a prior article, the applicability of the FMCSRs to property carriers generally depends on the weight of those vehicles and whether they are operating in interstate commerce. On the other hand, the applicability of the FMCSRs to passenger carriers depends on a few different factors, including the seating capacity of the vehicles and whether they are operating in interstate commerce.

What is and is not "interstate commerce," particularly for passenger operations, is a sticky subject. And whether (and to what extent) passenger carriers require operating authority and are subject to the FMCSRs can be difficult concepts to grasp.

This in mind, the FMCSA published regulatory guidance to help clarify some of these complexities. That's what we're breaking down in this article.

What's the purpose of FMCSA's passenger carrier guidance?

FMCSA explains that its guidance "adds appendices to [FMCSRs] to explain existing statutes and regulations FMCSA administers related to: the applicability of the FMCSRs, including the financial responsibility regulations, to motor carriers of passengers operating in interstate commerce, including limitations on such applicability based on characteristics of the vehicle operated or the scope of operations conducted; and the applicability of commercial operating authority registration based on the Agency’s jurisdiction over motor carriers of passengers, regardless of vehicle characteristics, when operating for-hire in interstate commerce." In short, the guidance seeks to harmonize the various provisions of the FMCSRs that apply to passenger carriers and clarify certain distinctions made within those regulations. The agency does so by adding an appendix (Appendix A) to Part 390 of the FMCSRs, which houses this guidance.

What types of passenger carriers are subject to the FMCSA's jurisdiction?

As explained in the FMCSA's guidance, "the jurisdictional thresholds of the statutes FMCSA administers and the corresponding regulations are not uniform." That said, for the most part, the agency’s safety-related jurisdiction is based upon the definition of commercial motor vehicle (CMV) in the Motor Carrier Safety Act of 1984 (MCSA), as codified in 49 CFR 390.5.

As we explained in another article, under that definition, a passenger vehicle is a commercial motor vehicle if it is designed or used to transport 9 or more passengers for compensation or 16 or more passengers regardless of compensation status. Additionally, passenger vehicles qualify as CMVs irrespective of their seating capacity if they weigh more than 10,000 lbs. Thus, the FMCSA's safety jurisdiction does not extend to passenger-carrying vehicles that: (1) are designed and used to transport 8 or fewer passengers, (2) have a GVWR and GVW of 10,000 pounds or less, and (3) are not transporting hazardous materials in a quantity that requires placarding.

Adding to the complexity, the FMCSRs include a separate and distinct definition of CMV, which governs the commercial driver's license (CDL) program and corresponding drug/alcohol testing regulations in Parts 383 and 382, respectively. Unlike the first definition that we described above, which applies only to interstate operations, this definition applies to passenger carriers involved in either interstate or intrastate commerce. The definition applicable to Parts 383 and 382 includes any motor vehicle that has a GVWR or GVW of 26,001 pounds or more and is used to transport passengers, regardless of the number of passengers that the vehicle is designed to or actually does transport. It also includes any vehicle designed or used to transport 16 or more passengers.

Lastly, and putting aside safety-related regulations, the FMCSA also administers certain "commercial regulations," aimed at ensuring certain types of carriers are properly licensed and authorized. As they pertain to passenger carriers, these regulations are generally applicable to for-hire interstate transportation of passengers in any vehicle, no matter the GVW, GVWR, or passenger capacity. However, the required level of insurance--which is often linked to these commercial regulations--does, in fact, depend on the number of passengers the carrier's vehicles are designed to transport. For example, the required level of insurance is $1.5 million if the carrier’s largest vehicle has a seating capacity of 15 or fewer passengers or $5 million if the largest vehicle has a seating capacity of 16 passengers or more.

Who is exempt from FMCSA's jurisdiction?

Assuming a carrier falls into one of the regulated categories listed above, it is subject to FMCSA's jurisdiction, unless a specific exemption applies. The FMCSRs codify a number of passenger-carrier exemptions, which we discuss below. If a carrier's operations fit within any of these exemptions, then they are no longer subject to FMCSA's jurisdiction regardless of whether their vehicles otherwise qualify as CMVs under the applicable definitions.

Transportation of Passengers to and From Airports and Other Points of Interstate Departure/Arrival. Carriers who transport persons or property that is incidental to transportation by aircraft are exempt from the operating authority component of the FMCSA's commercial regulations. Historically, many believed that this exemption only applied in situations where the air movement and the ground movement were all booked together on what are known as "through tickets." However, in its guidance, FMCSA clarifies, "through-ticketing is not required for the exemption from commercial operating authority registration for transportation incidental to air travel in 49 U.S.C. 13506(a)(8)(A) to apply. However, prearranged motor vehicle transportation, secured by an advance guarantee demonstrating an obligation by the passenger to take the service, and by the motor carrier to provide the service immediately prior or subsequent to aircraft transportation across State lines, is part of a continuous movement in interstate commerce. This understanding is the most consistent means for determining the passenger’s fixed and persisting intent to continue in interstate transportation to a final destination absent a through ticket, or bill of lading one would have when shipping property. Motor carriers performing intrastate movements of interstate air passengers thus do not need operating authority registration if they operate only within the radius specified as “incidental to transportation by aircraft” in § 372.117(a), but they are nevertheless operating in interstate commerce and are subject to the FMCSRs unless they are otherwise exempt." Importantly, this exemption is from the operating authority requirement only; it is not an exemption from the safety regulations.

Intrastate operations. As noted previously, aside from the FMCSA's CDL and drug/alcohol testing rules, the remainder of its safety regulations and commercial regulations apply only to carriers involved in interstate commerce. That said, many states in the country regulate intrastate passenger carrier operations. Nevertheless, the FMCSA addresses in its guidance the question of whether a de minimum amount of interstate passenger carrier operations would exempt a carrier from the FMCSA's oversight. To this point, the agency clarifies, "Many motor carriers have a mixture of interstate and intrastate passenger transportation operations. To answer this question, we look back to a case interpreting the Fair Labor Standards Act of 1938. In this case, only 3 to 4 percent of a carrier’s trips were interstate in nature, and the Supreme Court held that, under the 1935 Act, the ICC had authority to impose its hours of service rules on all of the company’s drivers because they were randomly assigned to handle interstate trips, even though 2 out of about 40 drivers had not made a single interstate trip during the 21 months at issue in that case (Morris v. McComb, 332 U.S. 422 (1947)) . . . The Agency may, therefore, require compliance with the FMCSRs by passenger carriers with interstate operations no more extensive than those previously described in Morris v. McComb, providing those operations are undertaken with CMVs, as defined in §§ 390.5T and 390.5." Further, with respect to hours-of-service regulations, specifically, the agency explains, "FMCSA takes this occasion to reaffirm the view expressed in the Acting Deputy Administrator’s 2001 letter that the Agency has jurisdiction over motor carriers, vehicles, and drivers for a 4-month period after a trip in interstate commerce."

Not for-hire/Not for compensation. As addressed above, certain carriers who transport passengers but receive no compensation for that transportation are not subject to the FMCSA's safety-related regulations. In its guidance, FMCSA clarifies, "The FMCSRs incorporate “compensation” into the definition of for-hire motor carrier, which the rules treat as “a person engaged in the transportation of goods or passengers for compensation” (§§ 390.5T and 390.5). In a notice of interpretation published on May 7, 1993, FHWA provided an expansive interpretation of “compensation,” stating that compensation includes both direct and indirect payment. In addition, FHWA said certain nonbusiness organizations, including churches and charities, operate as for-hire passenger carriers when they engage in chartered operations, charging a fee (58 FR 27328, 27329). The notice clarified that certain businesses, including hotels and car rental agencies operating shuttle bus services, and outdoor recreation operations such as whitewater rafting outfits and scuba diving schools transporting patrons to or from a recreation site, constitute for-hire motor carriage of passengers. “Compensation” as used in the context of a business enterprise includes both direct and indirect payment for the transportation service provided. It need not mean “for profit" . . . “Compensation,” as used in the definition of for-hire motor carrier in §§ 390.5T and 390.5, includes both direct and indirect payments. Companies providing intercity motorcoach service are directly compensated, while hotels, car rental companies, parking facilities, and other businesses that offer shuttle bus service are indirectly compensated because they add the cost of that service to their room rates, car rental rates, etc. By statute, most taxicab service is not subject to the requirement to obtain commercial operating authority registration (49 U.S.C. 13506(a)(2)) or to maintain minimum levels of financial responsibility (49 U.S.C. 31138(e)(2), § 387.27(b)(2)). In addition, most taxis are not subject to the FMCSRs because their designed passenger capacity is below nine and their GVW is too low to make them CMVs under §§ 390.5T and 390.5."

Jurisdictional Examples

A large portion of the FMCSA's guidance is devoted to specific transportation examples and the agency's guidance on whether and to what extent such transportation implicates the agency's rules. We are including these examples in full below.

Passengers Using Multiple Transportation Modes

Scenario 1: A couple plans an interstate trip, for vacation. They hire a limousine to transport them from their residence to an airport, with a final destination out of state. This highway transportation is within a single State. The aircraft transports the couple to another State. After landing and obtaining checked baggage, the couple boards a mini- bus, which they reserved while planning the trip from their home, that transports them within the second State to a waterway port. The couple boards a cruise ship that transports them to foreign island countries.

Guidance: This scenario describes for-hire transportation by motor vehicle as a part of continuous interstate movement. Because the transportation was prearranged, both the limousine operator and the mini-bus operator may be required to comply with some if not all of the FMCSRs. Assuming prearrangement, both operators would require operating authority registration under 49 CFR part 365, subpart A, unless the “incident to air travel” exemption at 49 U.S.C. 13506(a)(8)(A) and § 372.117(a) applied. (See Scenario 3 below.) If the vehicles are CMVs under either the MCSA or the CMVSA, then the respective safety regulations, including the registration and applicable safety requirements in 49 CFR parts 390 through 399, and/or the CDL and drug and alcohol testing regulations in parts 382 and 383, would apply to the operations.

If a passenger plans a trip involving more than one mode of transportation that begins and ends in different States or a place outside the United States, and has prearranged the CMV portion of the trip, secured by an advance guarantee demonstrating an obligation by the passenger to take the service and the motor carrier to provide the service, all transportation during the trip is in interstate commerce because the passenger prearranged the transportation with fixed and persistent intent of continuous interstate movement throughout the trip. Additional prearranged side trips or excursions made before the trip begins or while traveling in interstate commerce are included as part of the flow of interstate commerce. However, if the passenger has made no arrangement for transportation upon arriving at an airport, waterway port, or railway station, and then makes arrangements for transportation, that transportation is not a continuation of the trip and is not in interstate commerce.

Scenario 2: A company offering sightseeing tours operates buses designed to transport more than 15 passengers including the driver. It picks up cruise ship passengers at a port of call, takes them to nearby attractions, and returns them to the ship. The bus tour does not cross State lines, but all cruises originate in another State or foreign country. The cruise passengers book and pay for the bus tour before starting, or during, the cruise. The passenger transportation is not confined to a commercial zone.

Guidance: This scenario describes for-hire transportation by a commercial motor vehicle as a part of continuous interstate movement. FMCSA’s position is that the company is a motor carrier subject to all applicable FMCSRs, including parts 350 through 399, and it must have registered by following the procedures in 49 CFR part 365 subpart A and part 390 subpart E. In addition, the company is operating a CMV, as defined in § 383.5, designed to transport 16 or more passengers. The bus driver must therefore hold a valid CDL with the applicable endorsement(s) and must comply with the drug and alcohol testing regulations in part 382.

In this instance, it is clear that the passengers prearranged the sightseeing tour and intended to continue in interstate transportation. Because the company is operating a commercial motor vehicle, a for-hire passenger vehicle with a seating capacity of at least 16 in interstate commerce, the company is required under §§ 387.33T and 387.33 to obtain and maintain $5 million of financial responsibility and to file evidence of the same with FMCSA.

Prearranged intrastate highway transportation occurring during an interstate trip is in the stream of interstate commerce, exactly like prearranged highway transportation immediately before or after an interstate trip. The fixed and persistent intent of the cruise ship passengers to travel by bus as part of the interstate cruise was demonstrated by their advance booking of the bus tour.

Scenario 3: While planning a trip, a person goes online, books an airline flight to a city in another State, and reserves a rental car in that city. The car rental company is located near the airport, and it offers shuttle bus service between the terminal and the facility where its customers can pick up and drop off cars. The shuttle does not require a reservation. The car rental company always has at least one shuttle vehicle circulating between the airport and its parking lot during business hours. All shuttle vehicles have a GVWR of 10,001 pounds or more and are designed to transport 16 or more passengers (including the driver). All shuttle operations are (1) conducted on roads and highways that are open to public travel, and (2) confined to a zone encompassed by a 25-mile radius of the boundary of the airport.

Guidance: This scenario describes for-hire transportation by a CMV as a part of continuous interstate movement, though limited exemptions apply. The company operates CMVs, as defined in §§ 390.5T and 390.5, for hire in interstate commerce, and the company is a motor carrier subject to all applicable FMCSRs, including parts 350 through 399, and it must register by following the procedures in 49 CFR part 390 subpart E. In addition, the company is operating a passenger-carrying CMV designed to transport 16 or more passengers, as defined in § 383.5. The bus driver must hold a valid CDL with the applicable endorsement(s) and comply with the drug and alcohol testing regulations in 49 CFR part 382.

Nonetheless, the company is not required to obtain operating authority registration. The shuttle service qualifies for the exemption from operating authority in 49 U.S.C. 13506(a)(8)(A) and § 372.117(a) for the transportation of passengers by motor vehicle that is (1) incidental to the transportation by aircraft, (2) limited to the transportation of passengers who have had or will have an immediately prior or subsequent movement by air, and (3) confined to a zone encompassed by a 25-mile radius of the boundary of the airport. Although the shuttle service, unlike the airline or rental car reservation, is not explicitly prearranged, it is in the stream of interstate commerce because customers expect and intend to utilize the service wherever a rental facility is not within walking distance of the airport terminal.

Though operating authority registration is not required, the company is operating passenger vehicles with a seating capacity of at least 16 for hire in interstate commerce and, accordingly, is required under §§ 387.33T and 387.33 to maintain $5 million of financial responsibility.

Hotel Related Passenger Transportation

Scenario 1: A hotel in Cincinnati, OH offers a courtesy van to take its guests to and from the Cincinnati/Northern Kentucky International Airport in KY. The van is designed to transport 15 passengers, including the driver, and has a GVW and GVWR of less than 10,000 pounds. All passenger transportation occurs within a zone encompassed by a 25-mile radius of the boundary of the airport.

Guidance: This scenario describes for-hire transportation by a CMV as a part of continuous interstate movement, though some exemptions apply. Though the safety regulations apply to transportation in a CMV within a single State if the transportation is a continuation of interstate transportation, the hotel’s van operation is eligible for the limited exception to safety regulation applicability in §§ 390.3T(f)(6) and 390.3(f)(6) based on the size of the vehicle and how compensation is received. The hotel’s van is designed and used to transport 9 to 15 passengers (including the driver), and payment for transportation is not received directly. If the hotel complies with the applicable provisions listed in §§ 390.3T(f)(6) and 390.3(f)(6), then this passenger transportation is compliant with the safety regulations contained in 49 CFR parts 350 through 399. Because the vehicle is a CMV under § 390.5 and the limited exception does not exempt the hotel from USDOT registration requirements, the hotel must register by following the procedures in 49 CFR part 390 subpart E. The hotel’s 15-passenger van is not a CMV under § 383.5, therefore drivers of these vehicles are not required to have CDLs and are not subject to the drug and alcohol testing regulations in 49 CFR part 382.

Operating authority registration under 49 CFR part 365, subpart A, however, is not required. The hotel is providing service subject to the exemption in 49 U.S.C. 13506(a)(8)(A) and § 372.117(a). The hotel’s shuttle transportation of passengers is (1) incidental to transportation by aircraft, (2) limited to the transportation of passengers who have had an immediately prior or will have an immediately subsequent movement by air, and (3) confined to a zone encompassed by a 25-mile radius of the boundary of the airport at which the passengers arrive or depart. The hotel does not meet the exemption requirements of 49 U.S.C. 13506(a)(3) for a motor vehicle owned or operated by or for a hotel and only transporting hotel patrons between the hotel and the “local station of a carrier.” The definition of carrier within this exemption means motor carrier, water carrier and freight forwarder but does not include air carrier. 49 U.S.C. 13102(3). However, the hotel only needs to meet the requirements of one exemption to not be subject to operating authority registration.

The hotel is providing indirectly compensated, for-hire transportation of passengers in interstate commerce in a vehicle with a seating capacity of 15 and is required under §§ 387.33T and 387.33 to maintain $1.5 million of financial responsibility.

Scenario 2: A hotel in Winchester, VA, located 12 miles outside of the zone encompassed by a 25-mile radius of the boundary of Washington Dulles International Airport, offers a courtesy van to take its guests to and from the airport in Dulles, VA. The van is designed to transport 15 passengers, including the driver, and has a GVW and GVWR of less than 10,000 pounds.

Guidance: This scenario describes for-hire transportation by a CMV as a part of continuous interstate movement, though some exemptions apply. Though the hotel is providing interstate transportation in a CMV, a 9 to 15 passenger vehicle operated for compensation, the hotel’s van operation is eligible for the limited exception to regulatory applicability in §§ 390.3T(f)(6) and 390.3(f)(6).

This exemption does not relieve the hotel of the requirements in 49 CFR part 365 for operating authority registration. The hotel is providing interstate for-hire transportation (the costs for operating the shuttle van are included in the cost of the room, as an amenity) outside the zone that would qualify it for the incidental to air travel exemption within 49 U.S.C. 13506(a)(8)(A) and § 372.117(a). Also, the hotel’s transportation does not meet the exemption requirements of 49 U.S.C. 13506(a)(3) for a motor vehicle owned or operated by or for a hotel and only transporting hotel patrons between the hotel and the local station of a carrier. The definition of carrier applicable to this exemption, at 49 U.S.C. 13102(3), does not include air carrier. The hotel must register by following the procedures in 49 CFR part 365 subpart A and part 390 subpart E. The hotel is also required under §§ 387.33T and 387.33 to obtain, file, and maintain $1.5 million of financial responsibility. The hotel’s 15-passenger van is not a CMV under § 383.5. Therefore, drivers of these vehicles are not required to have CDLs and are not subject to the drug and alcohol testing regulations in 49 CFR part 382.

Employer Related Passenger Transportation

Scenario 1: A commercial building cleaning company owns and operates 15- passenger vans to transport its employees to client locations to perform cleaning services. The employer is located close to a State boundary, and employees are transported into a neighboring State. When employees are transported outside a specified distance from the company’s single office location, the employer provides the transportation free of charge. However, when employees are transported wholly within the specified distance, the employer charges each employee a transportation fee and deducts that amount from the employee’s pay. Most of this employee transportation is outside the commercial zone of the municipality where the company’s office is located and where passenger transportation originates. All of the company’s drivers and vehicles are at some point involved in interstate passenger transportation outside the commercial zone.

Guidance: This scenario describes for-hire transportation by a CMV as a part of continuous interstate movement, though some exemptions apply. The company is operating 15-passenger vans for compensation in interstate commerce, satisfying the definition of a CMV under § 390.5. Accordingly, the company must comply with the applicable regulations in 49 CFR parts 350 through 399. Because the employer charges each employee a transportation fee and deducts that amount from the employee’s pay, the compensation is direct, and the company therefore does not qualify for the limited exception in §§ 390.3T(f)(6) and 390.3(f)(6) for 9 to 15 passenger-carrying CMVs operated not for direct compensation.

There are no exemptions to the commercial regulatory requirements for this interstate, for-hire motor vehicle operation. The company must register by following the procedures in 49 CFR part 365 subpart A and part 390 subpart E. The company is also required to obtain, maintain, and file financial responsibility of $1.5 million, as required under §§ 387.33T and 387.33.

The drivers of these 15-passenger vans, however, are not required to have CDLs and are not subject to employer-conducted controlled substances and alcohol testing because the vehicles are not CMVs as defined in § 383.5. Although the drivers are not required to hold a valid CDL, they are subject to the general driver qualification regulations in part 391, including the requirements to be medically examined and certified in accordance with §§ 391.41, 391.43, and 391.45.

Scenario 2: A construction company owns and operates a bus designed to transport more than 15 passengers including the driver. The bus transports employees to work sites and does not charge a fee for the transportation. At the request of its employees, the company uses the bus on a Saturday during the summer to provide round- trip transportation for interested employees to an amusement park in a neighboring State. This trip is open only to employees and people the employees invite. The company collects money from each passenger. The transportation is not confined within a commercial zone.

Guidance: This scenario describes for-hire interstate transportation by a CMV as defined in §§ 390.5T and 390.5. The transportation is subject to all the applicable regulations in 49 CFR parts 350 through 399. The company must register for operating authority registration and USDOT number registration by following the procedures in

49 CFR part 365 subpart A and part 390 subpart E. In addition, the bus is also a CMV as defined in 49 CFR § 383.5, and the driver must hold a valid CDL with a Passenger endorsement and must comply with the drug and alcohol testing regulations in 49 CFR part 382. If the company operates its CMV in interstate commerce only on rare occasions, FMCSA has jurisdiction over the company, such vehicle, and the driver of such vehicle for a 4-month period after a trip in interstate commerce. However, records must be retained for whatever period is required by the FMCSRs, even if that period exceeds 4 months.

Operating authority registration is required in this scenario only because the construction company provided a trip for compensation to the amusement park in another State. Operating authority registration would not be necessary if the company limited its transportation to the free transportation provided for employees to travel to work sites.

Finally, because the company operates passenger vehicles with a seating capacity of at least 16 in interstate commerce, it must maintain financial responsibility of at least $5 million, as required under §§ 387.33T and 387.33. As long as the company is engaged in for-hire operations, evidence of financial responsibility must be maintained on file with FMCSA.

Education-Related Passenger Transportation

Scenario 1: A non-profit organization conducts educational tours with 15- passenger vans. All tours can be booked as part of a classroom course, or as a stand-alone tour. Each tour crosses either a State or international border, beyond a commercial zone. Passengers pay a single, inclusive of transportation fee whether they book a tour or a tour combined with a classroom lecture. The 15-passenger vans have a GVWR and actual GVW under 10,000 pounds.

Guidance: This scenario describes for-hire transportation by a CMV as defined in §§ 390.5T and 390.5, as a part of continuous interstate movement. The vans used by this organization are CMVs under §§ 390.5T and 390.5 because they have a passenger capacity of more than eight and are used to transport passengers for compensation in interstate commerce. However, the organization is eligible for the limited exception to regulatory applicability in §§ 390.3T(f)(6) and 390.3(f)(6) because (1) the vans are designed or used to transport between 9 and 15 passengers, (2) the organization does not receive direct compensation, and (3) the vans meet none of the alternative definitions of a CMV such as a GVW or GVWR of 10,001 pounds or more. The drivers of these vans do not need CDLs because the vehicles are not CMVs under § 383.5; both their passenger capacity and weight are below the applicable thresholds. For the same reasons, the drivers of these vans are not subject to the drug and alcohol testing regulations in 49 CFR part 382. The organization must register by following the procedures in 49 CFR part 365 subpart A and part 390 subpart E because the operations clearly included interstate transportation for compensation in a motor vehicle and no exemptions from FMCSA’s commercial regulatory authority apply.

The organization transports passengers across State lines and includes the cost of transportation in a flat rate fee. Its non-profit status is irrelevant. A carrier that receives compensation, even indirect compensation, is providing for-hire service, and, because the carrier operates beyond a commercial zone, it must obtain operating authority registration from FMCSA. This organization is not a youth or family camp, and the statutory exemption from operating authority registration for such camps that provide recreational or educational activities therefore does not apply. Further, the organization is engaged only in educational activities. Therefore, the exemption for providers of recreational activities does not apply.

Because the organization operates passenger vehicles with a seating capacity of 15 or fewer for hire in interstate commerce, the organization is required under

§§ 387.33T and 387.33 to obtain, maintain, and file evidence of, $1.5 million of financial responsibility.

Scenario 2: A school bus contractor is hired by a school district to transport high school athletes, faculty, and volunteers to and from an athletic competition in another State on a single day. During the following week, the same school bus contractor is hired by the same school district to transport elementary school students and faculty to and from a historic site in another State for an educational tour. The school bus used by the contractor is designed to transport more than 15 passengers including the driver.

Guidance: This scenario describes for-hire interstate transportation by a CMV as defined in §§ 390.5T and 390.5, however, some exemptions may apply. The contractor is not eligible for the exception for “school bus operations” in §§ 390.3T(f)(1) and 390.3(f)(1) because the operations are defined in §§ 390.5T and 390.5 as the transportation of school children and/or personnel “from home to school and from school to home.” In this scenario, the students and faculty gather at the school and are transported, not from and to home, but from the school premises to out-of-State venues and then back to the school premises. The school bus contractor must obtain safety registration and a USDOT number under 49 U.S.C. 31134. The contractor must register by following the procedures in 49 CFR part 390 subpart E. In addition, the contractor is operating a school bus with a passenger capacity of at least 16, which also meets the definition of CMV under § 383.5. The drivers of the school buses must therefore hold CDLs with the applicable endorsements, and the employer of such drivers must administer a drug and alcohol testing program in compliance with part 382.

Although both examples of the school bus contractor’s passenger transportation are for-hire in interstate commerce, the contractor is not required to obtain operating authority registration. In this scenario the contractor is engaged in transportation to or from school, and the transportation is organized, sponsored, and paid for by the school district. The regulatory exception in § 372.103 and the statutory exemption in 49 USC 13506(a)(1) both apply to each type of passenger transportation conducted by the school bus contractor in this scenario. Likewise, the school bus contractor qualifies for the exception in § 387.27(b)(4) because it is a motor carrier operating under contract providing transportation of preprimary, primary, and secondary students for extra-curricular trips organized, sponsored, and paid for by a school district. Accordingly, the contractor is not required to comply with Federal financial responsibility requirements.

Scenario 3: A private university transports only student athletes and university employees to games, sometimes in other States, in university-owned buses, which are designed to transport more than 15 passengers including the driver. The passenger transportation is financed by an allotment in the university athletic department’s budget.

Guidance: This scenario describes interstate transportation by a CMV as defined in §§ 390.5T and 390.5, however, some exemptions may apply. The private university is a private motor carrier of passengers (business) operating CMVs, as defined in §§ 390.5T and 390.5, in interstate commerce. The private university fits within this definition because the financing of passenger transportation comes from a university budget source, not from payments or charges for transportation either directly or embedded in other tuition and fees. The transportation is only available to students and university employees, not the public at large. Private universities typically operate as commercial enterprises, as the passenger transportation to sporting events is in furtherance of the university’s business and are an element of the institution’s operations. Thus, transportation of students and faculty is in furtherance of its commercial purpose. The possible absence of ticket sales to sporting event spectators does not affect the commercial nature of the enterprise.

Except as noted in the next paragraph, the transportation is subject to the requirements of 49 CFR parts 350 through 399 relevant to passenger carrier operations. The university must register by following the procedures in 49 CFR part 390 subpart E. In addition, the private university’s bus is a CMV as defined in § 383.5, and the driver must hold a valid CDL with a Passenger endorsement and be enrolled in a drug and alcohol testing program consistent with 49 CFR part 382.

There is a regulatory exception in § 391.69, however, from certain driver qualification requirements relating to applications for employment, investigations and inquiries, and road tests for single-employer drivers employed by a private motor carrier of passengers (business). Additionally, private motor carriers of passengers (business) may also continue to operate older buses manufactured before Federal fuel system requirements were adopted, provided the fuel system is maintained to the original manufacturer’s standards (§ 393.67(a)(6)).

Because the private university is operating as a private motor carrier of passengers (business) it is not required to have operating authority registration. The operation is not for-hire because the private university does not receive payment for transportation services. Though in this scenario the transportation is not for-hire, it is important to reiterate that an entity’s tax-exempt or non-profit status does not determine whether its passenger transportation is for-hire or private. Currently, Federal financial responsibility requirements do not apply to operations by private motor carriers of passengers (business).

Scenario 4: A private high school owns and operates buses to transport students, baseball team members, and faculty to games in another State. One vehicle is a school bus with a capacity of 48 passengers. Two other vehicles are mini-buses designed to transport 26 passengers including the driver, and one other vehicle is a van designed to transport 15 passengers including the driver. The school does not transport students from home to school or vice versa. The passenger transportation is financed by an allotment in the school’s athletic department budget.

Guidance: This scenario describes some interstate transportation by a CMV as defined in §§ 390.5T and 390.5, however, some exemptions may apply. This scenario also describes some transportation outside the scope of FMCSA jurisdiction. The private high school is a private motor carrier of passengers (business) operating CMVs, as defined in §§ 390.5T and 390.5, in interstate commerce. The private high school fits within this definition because the financing of passenger transportation is from a general high school budget source, so there is no compensation for the transportation. The transportation is only available to students and school employees, not the public at large. Private schools typically operate as commercial enterprises as the passenger transportation to sporting events is in furtherance of the school’s business, including its athletic activities which are an element of the institution’s operations. Thus, transportation of students and faculty is in furtherance of its commercial purpose. The possible absence of ticket sales to sporting event spectators does not affect the commercial nature of the enterprise.

The transportation in larger vehicles is subject to the requirements of 49 CFR parts 350 through 399 relevant to passenger carrier operations. The school must register by following the procedures in 49 CFR part 390 subpart E. Because the private high school is a private motor carrier of passengers (business), not providing interstate transportation for compensation, it is not required to have operating authority registration under 49 CFR part 365. Whether the private high school is tax-exempt or has a non-profit status does not determine whether its passenger transportation is for-hire or private. The school is not required to comply with Federal financial responsibility requirements.

In addition, other than the van, the private high school’s vehicles are CMVs as defined in 49 CFR 383.5, and the drivers of these vehicles must have CDLs with Passenger endorsements and be enrolled in a drug and alcohol testing program consistent with 49 CFR part 382.

The van is not a CMV because it is designed to transport 15 passengers including the driver and it is not transporting passengers for compensation. A vehicle is considered a CMV only if it is used to transport 16 or more passengers in interstate commerce, regardless of the nature of compensation; or if is used to transport 9 to 15 passengers including the driver for compensation in interstate commerce.

There is a regulatory exception in § 391.69, however, from certain driver qualification requirements relating to applications for employment, investigations and inquiries, and road tests for single-employer drivers employed by a private motor carrier of passengers (business). Additionally, private motor carriers of passengers (business) may continue to operate older buses manufactured before Federal fuel system requirements were adopted, provided the fuel system is maintained to the original manufacturer’s standards (§ 393.67(a)(6)).

Faith-Based Organizations and Passenger Transportation

FMCSA frequently receives questions from religious and secular organizations regarding passenger-carrying vehicles the organizations own and use to transport their members and guests. The scenarios presented below are illustrative examples; the same principles apply to secular groups with similar operations.

Scenario 1: To raise funds, a faith-based organization organizes a one-time trip to an amusement park in a neighboring State. The organization advertises the trip on its website and in various public places such as grocery stores, libraries, etc., making the trip open to the public. A per-person fee will cover admission to the amusement park and round-trip transportation. The faith-based organization will use its own bus, which is designed to transport more than 15 passengers including the driver. A group member is the volunteer bus driver. The passenger transportation is not confined to a commercial zone.

Guidance: This scenario describes for-hire interstate transportation by a CMV. The faith-based organization’s bus is a CMV, as defined in §§ 390.5T and 390.5, operating for-hire in interstate commerce, and the organization is a motor carrier subject to all applicable FMCSRs, including parts 350 through 399. In addition, the faith-based organization is operating a passenger-carrying CMV, as defined in § 383.5 because it is designed to transport 16 or more passengers; the driver of the organization’s bus must therefore hold a valid CDL with a Passenger endorsement and comply with the drug and alcohol testing regulations in part 382.

The organization must register by following the procedures in 49 CFR part 365 subpart A regarding operating authority registration and part 390 subpart E regarding USDOT number registration, because it is receiving compensation for transportation in interstate commerce. No exemptions apply to this operation.

The faith-based organization is operating a passenger vehicle with a seating capacity of at least 16, for-hire in interstate commerce and is therefore required under §§ 387.33T and 387.33 to maintain $5 million of financial responsibility.

Scenario 2: A faith-based organization owns a bus which it uses to transport some of its members to an associated organization in another State. It suggests participating members contribute money to help cover the fuel expense. The bus is designed to transport more than 15 passengers including the driver. The transportation of the faith-based organization members is not confined to a commercial zone.

Guidance: This scenario describes for-hire interstate transportation by a CMV. The faith-based organization’s bus is a CMV, as defined in §§ 390.5T and 390.5, operating in interstate commerce, and the organization is a motor carrier subject to all applicable FMCSRs, including parts 350 through 399. In addition, the faith-based organization is operating a passenger-carrying CMV, as defined in § 383.5 because it is designed to transport 16 or more passengers; the driver of the organization’s bus must therefore hold a valid CDL with a Passenger endorsement and comply with the drug and alcohol testing regulations in part 382. The money provided from the organization’s members for the trip constitutes direct compensation. Any type of compensation for providing a passenger transportation service makes the faith-based organization a for-hire motor carrier of passengers. The organization must register by following the procedures in 49 CFR part 365 subpart A regarding operating authority registration and part 390 subpart E regarding USDOT number registration.

The faith-based organization is using a bus with a seating capacity of 16 or more to transport passengers for hire in interstate commerce and is thus required under §§ 387.33T and 387.33 to maintain financial responsibility of at least $5 million. The monetary contribution requested of each passenger constitutes compensation, making the faith-based organization a for-hire motor carrier.

Scenario 3: A faith-based organization sponsors a trip for its members to an amusement park in a neighboring State. The trip is announced in the organization’s newsletters, but not advertised to the general public. Group members may invite friends and family, including non-members, to join. An event fee paid by all trip participants covers transportation, lodging, food, and admission to the amusement park. The organization’s bus that will be used for the trip is designed to transport more than 15 passengers, including the driver. The trip will extend beyond the commercial zone of the city where the organization is located.

Guidance: This scenario describes for-hire, interstate transportation by a CMV. The faith-based organization’s bus is a CMV, as defined in §§ 390.5T and 390.5, operating in interstate commerce, and the faith-based organization is a motor carrier subject to all applicable FMCSRs, including parts 350 through 399. In addition, the faith- based organization is operating a passenger-carrying CMV, as defined in § 383.5 because it is designed to transport 16 or more passengers; the driver of the bus must therefore hold a valid CDL with a Passenger endorsement and comply with the drug and alcohol testing regulations in part 382.

The organization is providing interstate motor vehicle transportation for compensation indirectly through the event fee, thus it must register by following the procedures in 49 CFR part 365 subpart A regarding operating authority registration and part 390 subpart E regarding USDOT number registration. The organization is a for-hire motor carrier even though the trip is not available to the public at large.

The organization is an interstate for-hire motor carrier of passengers compensated indirectly through the event fee. Because there is no applicable exception, it must maintain the $5 million of financial responsibility required to operate a vehicle with a seating capacity of at least 16 passengers (§§ 387.33T and 387.33).

Scenario 4: A high school cheerleading team wants to travel to a neighboring State to participate in a cheerleading competition. A parent of one cheerleader is a member of a faith-based organization that owns a bus designed to transport more than 15 passengers including the driver. The parent persuades the faith-based organization to take the team to the competition. The cheerleaders and their parents give the faith-based organization money for use of the bus, and the faith-based organization pays one of its members to drive it. The trip is not confined to a commercial zone.

Guidance: This scenario describes for-hire interstate transportation of passengers by a CMV. The faith-based organization’s bus is a CMV, as defined in § 390.5, operating for hire in interstate commerce, and the organization is a motor carrier subject to all applicable FMCSRs, including parts 350 through 399. In addition, the faith-based organization is operating a passenger-carrying CMV, as defined in § 383.5 because it is designed to transport 16 or more passengers; the driver of the faith-based organization’s bus must hold a valid CDL with a Passenger endorsement and comply with the drug and alcohol testing regulations in part 382. This is for hire interstate transportation of passengers by motor vehicle because the families pay the organization to use the bus and no exemptions apply to the operation. Thus, operating authority registration is required. The organization must register by following the procedures in 49 CFR part 365 subpart A regarding operating authority registration and part 390 subpart E regarding USDOT number registration.

Likewise, because the faith-based organization is operating a passenger vehicle with a seating capacity of at least 16, for-hire in interstate commerce, it is required under §§ 387.33T and 387.33 to maintain $5 million of financial responsibility.

Scenario 5: A faith-based organization with many charitable operations provides transportation to a variety of passengers – both members of the organization and nonmembers – for a variety of events. For example, paid and volunteer collectors are sent to donation sites, the faith-based organization’s employees are taken to and from the location of coat and food drives, donors are transported to fundraising events, children in daycare are taken on trips, and various individuals are provided transportation for job training programs. The faith-based organization’s daycare center charges a fee for its services which include interstate passenger transportation. The faith-based organization uses different types of vehicles to transport its passengers. Some have a seating capacity of 16 or more passengers, and others have a seating capacity of 15 or fewer passengers. All passenger-carrying vehicles are used throughout the faith-based organization’s various transportation operations. In addition, all of the faith-based organization’s drivers operate a vehicle with a seating capacity of 16 or more passengers to transport the daycare children on interstate trips on at least an occasional basis. All of the various passengers are transported into another State.

Guidance: The daycare center-related transportation is for-hire interstate transportation of passengers by CMV. The organization operates CMVs, as defined in §§ 390.5T and 390.5, in interstate commerce as a for-hire motor carrier of passengers and is subject to the applicable FMCSRs in parts 350 through 399. The faith-based organization receives compensation through the collection of fees for services, including transportation, paid for the daycare, and all drivers and vehicles provide at least some transportation for the daycare. While some of the transportation operations are not for- hire, because all of the drivers and vehicles are used in all of the operations, the Agency considers the organization to be engaged in for-hire, interstate passenger transportation as well as private, interstate passenger transportation. While there is a limited exception from the safety regulations in parts 390 through 399 for smaller vehicles in §§ 390.3T(f)(6) and 390.3(f)(6), it does not apply to the organization because some of the organization’s passenger-carrying vehicles are designed or used to transport 16 or more passengers in interstate commerce. In addition, because some of the vehicles are designed to transport 16 or more passengers, and all of the drivers operate all of the different vehicles on occasion, all the drivers must have CDLs with Passenger endorsements, and the faith-based organization must comply with the drug and alcohol testing regulations in part 382.

Because the faith-based organization receives indirect compensation through the fees charged for the daycare center, it is operating as an interstate, for-hire motor carrier of passengers. No exemption from operating authority registration requirements applies. The organization must register, therefore, by following the procedures in 49 CFR part 365 subpart A regarding operating authority registration and part 390 subpart E regarding USDOT number registration.

Because the faith-based organization operates some passenger vehicles with a seating capacity of at least 16, for-hire in interstate commerce, it is required under §§ 387.33T and 387.33 to maintain $5 million of financial responsibility.

Scenario 6: A religiously-affiliated group of singers and musicians travels to various locations to perform at events and ceremonies. The group owns and operates multiple vehicles to transport its members and their equipment. Each vehicle has a GVWR and GVW of 10,001 to 26,000 pounds and is designed to transport more than 15 passengers including the driver. All the vehicles are driven between multiple States for performances. The hosting organizations ask event participants for donations which are provided to the musical group. Sometimes the musical group sells T-shirts, souvenirs, or other merchandise at the events.

Guidance: This scenario describes interstate transportation by CMV, but some exemptions may apply. The musical group is a private motor carrier of passengers (business) and is operating CMVs, as defined in §§ 390.5T and 390.5, in interstate commerce. The transportation is thus subject to 49 CFR parts 350 through 399 relevant to passenger carrier operations. The group is considered a private motor carrier of passengers (business) because the passenger transportation is not available to the public at large; but the receipt of money for a musical performance constitutes a business transaction, and a part of the furtherance of the musical group’s commercial enterprise. Thus, the transportation of members and equipment has a commercial purpose. The possible absence of merchandise sales does not affect the commercial nature of the enterprise, as the primary purpose is promotion of the group’s music, for which the group receives compensation. Whether a musical group is tax-exempt or has a non-profit status does not determine whether it is a business or nonbusiness. Finally, the transportation of passengers and equipment is an essential element of the group’s operations, and such transportation is in furtherance of its commercial enterprise. All of the donations received may be used to cover the cost of fuel, maintenance, depreciation and insurance on the vehicle, but the transportation nevertheless furthers a commercial purpose.

Accordingly, the musical group must register by following the procedures in 49 CFR part 390 subpart E regarding USDOT number registration. In addition, because the musical group’s vehicles are designed to transport more than 15 passengers including the driver, the drivers of these vehicles must have CDLs with a Passenger endorsement and be enrolled in a drug and alcohol testing program consistent with 49 CFR part 382. There is a regulatory exception in § 391.69, however, from certain driver qualification requirements relating to applications for employment, investigations and inquiries, and road tests for single-employer drivers employed by a private motor carrier of passengers (business). Additionally, private motor carriers of passengers (business) may also continue to operate older buses manufactured before Federal fuel system requirements were adopted, provided the fuel system is maintained to the original manufacturer’s standards (§ 393.67(a)(6)).

The musical group’s interstate transportation of its members is in furtherance of a commercial enterprise, but the group is not receiving compensation for providing transportation. The compensation received is for their musical performance. The members of the group likewise do not pay a fee for their transportation. The musical group is thus a private motor carrier of passengers (business), and such carriers are not required to obtain operating authority registration. The musical group is a private motor carrier of passengers (business), therefore, currently the group is not required to maintain evidence of financial responsibility on file with FMCSA. Private motor carriers of passengers are not required to obtain operating authority registration and are not subject to the financial responsibility requirements.

Miscellaneous Passenger Transportation

Scenario 1: An assisted living apartment community is a commercial business that owns and operates a bus designed to transport more than 15 passengers, including the driver. The drivers are employees of the apartment community. The bus is used to transport residents to medical appointments, shopping centers, theaters, etc. Routine local transportation within the State is financed by general fees paid by all community residents. The community office assesses a special charge for entertainment-related transportation. The general public is not allowed to use the bus service. Some trips to shopping centers and theaters go into a neighboring State, but all transportation remains in the commercial zone of the community.

Guidance: This scenario describes for-hire interstate transportation by commercial motor vehicle, but some exemptions apply. The community is operating a CMV, as defined in §§ 390.5T and 390.5, in interstate commerce. The fact that all passenger transportation is entirely within a commercial zone is irrelevant for purposes of the “interstate commerce” component of the definition of CMV under §§ 390.5T

and 390.5. The transportation is subject to all of the provisions in 49 CFR parts 350 through 399 relevant to passenger carrier operations. In addition, the 16-passenger van is also a CMV as defined in § 383.5, and the driver therefore must hold a valid CDL with a Passenger endorsement and be enrolled in a drug and alcohol testing program consistent with 49 CFR part 382.

Although the community is an interstate for-hire motor carrier of passengers assessing special charges for entertainment trips to a neighboring State, operating authority registration is not required because the transportation is wholly within the commercial zone where the community is located (49 U.S.C. 13506(b)(1)). However, the community must register by following the procedures in 49 CFR part 390 subpart E regarding USDOT number registration because the community operates a CMV, as defined in §§ 390.5T and 390.5, in interstate commerce.

Under §§ 387.33T and 387.33, the community must obtain and maintain $5 million of financial responsibility because it is a for-hire motor carrier of passengers operating in interstate commerce and at least one of its vehicles has seating for 16 or more passengers. The general fees paid by the community residents cover a multitude of services including local transportation. This indirect compensation arrangement for transportation is service for-hire. The special charge for entertainment-related transportation is direct compensation and is also a for-hire service.

Scenario 2: A youth camp transports campers in 15-passenger vans from an airport to the camp site and back, from the camp site to parks and other locations in neighboring States, and to facilities for medical care, etc. Trips to and from the airport extend beyond a 25-mile radius from the boundary of the airport and the commercial zone of the municipality that falls within the 25-mile radius of the airport. Other trips also extend beyond a commercial zone. Campers and camp employees are the only transported passengers. The vans have a GVW and GVWR below 10,001 pounds. The camp collects payment for the participating youth with a total package fee.

Guidance: If a single fee covers all services provided by the camp including transportation, most of the safety regulations would not apply to the camp. Although the camp operates CMVs as defined in §§ 390.5T and 390.5 in interstate commerce (more than 8 passengers, for compensation), it would qualify for the exception in §§ 390.3T(f)(6) and 390.3(f)(6) for CMVs designed or used to transport between 9 and 15 passengers not for direct compensation, and its vans meet none of the alternative definitions of a CMV (such as a GVW or GVWR of 10,001 pounds or more). The organization would therefore be required to comply only with those requirements specified in §§ 390.3T(f)(6) and 390.3(f)(6). Furthermore, the camp must register by following the procedures in 49 CFR part 390 subpart E regarding USDOT number registration.

However, if the camp collects a specific fee for passenger transportation, it is then receiving direct compensation and does not qualify for the limited exception in §§ 390.3T(f)(6) and 390.3(f)(6). If direct compensation occurs, the camp must comply with the applicable regulations in 49 CFR parts 350 through 399 including motor carrier registration in accordance with § 390.201. In the case of direct compensation, the drivers of these 15-passenger vans with a GVW and GVWR below 10,001 pounds are not required to hold a CDL and are not subject to employer conducted controlled substances and alcohol testing because such vehicles are not CMVs as defined in § 383.5. Although the drivers are not required to hold a CDL, they must be medically examined and certified in accordance with §§ 391.41, 391.43, and 391.45, and they are subject to the general driver qualification regulations in part 391 because such vehicles are CMVs as defined in §§ 390.5T and 390.5.

Though the camp is engaged in for-hire interstate transportation of passengers by motor vehicle, there is an exemption from operating authority registration requirements in 49 U.S.C. 13506(a)(16). This camp falls within the exemption, which limits the Agency’s jurisdiction over the transportation of passengers by 9- to 15-passenger motor vehicles operated by youth or family camps that provide recreational or educational activities.

Nonetheless, because the camp is an interstate for-hire motor carrier of passengers compensated indirectly through camp fees, it must maintain $1.5 million of financial responsibility (§§ 387.33T and 387.33). The camp is not required to maintain evidence of financial responsibility on file with FMCSA.

Conclusion

Determining whether or not your passenger-carrier operations are subject to federal safety or commercial regulations can be difficult. Often, it comes down to the size and seating capacity of the vehicles and whether those vehicles are operated in interstate commerce. The FMCSA's guidance offers a number of practical examples to help carriers determine whether and to what extent they are regulated.

If you need any assistance understanding the applicability of these regulations to your operations, please feel free to contact us.

About Trucksafe Consulting, LLC: Trucksafe Consulting is a full-service DOT regulatory compliance consulting and training service. We help carriers develop, implement, and improve their safety programs, through personalized services, industry-leading training, and a library of educational content. Trucksafe also hosts a monthly live show on its various social media channels called Trucksafe LIVE! to discuss hot-button issues impacting highway transportation. Trucksafe is owned and operated by Brandon Wiseman and Jerad Childress, transportation attorneys who have assisted some of the nation’s leading fleets to develop and maintain cutting-edge safety programs. You can learn more about Trucksafe online at www.trucksafe.com and by following Trucksafe on LinkedIn, Facebook, Twitter, and YouTube.